Have you ever wanted to buy something online but didn’t have enough money or credit? If yes, then you might be interested in Amazon’s new payment option: Amazon Pay Later. It allows customers to buy and receive products and pay them off in monthly installments or EMIs, without requiring a credit card or any upfront payment.

But is Amazon Pay Later really a good deal for customers? In this article, we will explore the advantages and disadvantages of Amazon Pay Later, and help you decide whether it is right for you or not.

Contents

Disadvantages Of Amazon Pay Later

Some of the disadvantages of Amazon Pay Later are:

#1 Eligibility Criteria And Data Sharing Requirements

It requires you to meet certain eligibility criteria and provide personal and financial information to avail of Amazon Pay Later. You need to have an Amazon account with a verified mobile number, a valid PAN card, a bank account with one of the selected banks, and one of the officially valid documents as address proof.

You also need to consent to share your information with Amazon’s lending partners – axio or IDFC FIRST Bank. This may raise some privacy and security concerns for some customers. 🔒

#2 Late Fee Charges

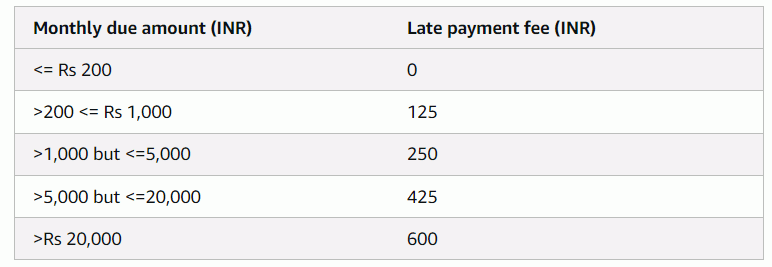

It requires you to repay the amount after a month. If you fail to do so, you may incur late payment fees and penalties, as well as damage your credit score. The late payment fee is 3% per month on the overdue amount, subject to a minimum of ₹100 and a maximum of ₹1,000.

The penalty is 0.5% per month on the overdue amount, subject to a minimum of ₹10 and a maximum of ₹500. The impact on your credit score may affect your future eligibility for loans or credit cards. 💳

#3 Negative Impact On Your Credit Score

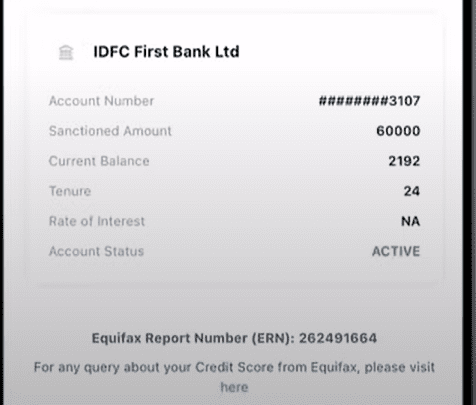

It shows an active loan in your credit report even when you don’t use Amazon Pay Later, which can impact your credit score significantly. This is because Amazon Pay Later is a form of revolving credit, which means you have a credit limit that you can use and repay as per your convenience.

However, this also means that your credit utilization ratio, which is the percentage of your available credit that you are using, may be high even if you don’t make any purchases using Amazon Pay Later. A high credit utilization ratio can lower your credit score and indicate that you are a risky borrower. Therefore, if you have lots of active loans in your credit report, you should not take the service of Amazon Pay Later as it can worsen your credit score. 📉

If you want to check the number of active loans under your name you can check in on OneScrore App.

Related: Is Amazon Pay Later Safe? How Can You Use It Safely?

#4 Risk Of Overspending

It may tempt you to overspend or buy unnecessary items using Amazon Pay Later, which can lead to debt accumulation and financial stress. You may end up buying more than you can afford or need and struggle to repay the amount on time. This can also affect your savings and investment goals. 💸

#5 Varying Interest Rates And Other Charges

You may not be aware of the interest rates and other charges applicable for different EMI tenures and may end up paying more than you expected. The interest rates vary from 0% to 18% per annum, depending on the EMI tenure and the product category. For example, if you buy a laptop worth ₹50,000 using Amazon Pay Later and choose a 12-month EMI tenure, you will have to pay an interest rate of 16% per annum, which means you will end up paying ₹56,000 in total. You may also have to pay GST and other taxes on the interest amount. 🧮

These are some of the disadvantages of Amazon Pay Later. However, you should also be aware of the advantages and benefits of using this payment option which have been discussed below.

Advantages Of Amazon Pay Later

Some of the advantages of using Amazon Pay Later are:

- It allows you to buy and receive products and pay them off in monthly installments or EMIs, without requiring a credit card or any upfront payment. This can help you manage your cash flow and budget better. 💰

- It gives you an instant decision on the credit limit by the lender, based on your eligibility criteria and personal and financial information. You can get a credit limit of up to ₹60,000, depending on your repayment history and credit score. 📈

Related: How to Increase the Credit Limit of Amazon Pay Later? (5 Ways)

- It does not charge you any processing or cancellation fee, or any pre-closure charges. You only have to pay the interest rate applicable for the EMI tenure you choose, which is nominal and transparent. 💸

- It offers you a seamless checkout experience on Amazon, where you can choose Amazon Pay Later as your payment option and select the EMI tenure that suits your needs. You can also track your purchases, repayments, and limit history from a simplified dashboard on the Amazon website or app. 🛍️

These are some of the advantages of using Amazon Pay Later.

How To Decide If Amazon Pay Later Is Suitable For You Or Not?

Now you are aware of all the advantages and disadvantages of Amazon Pay Later. Now you might be thinking should I apply for Amazon Pay Later or not? Don’t worry. I am going to make your choice of choosing Amazon Pay Later easier.

Amazon Pay Later is Suitable for you if:

- You frequently use Amazon for shopping and bill payments.

- You don’t have too many active loans under your name

- You are punctual in paying the bills on time.

- You have the quality of spending money judiciously. It may happen that this credit limit may tempt you to spend on things that are not useful for you. So before making a purchase. Ask yourself that “Do I really need this product?”

Now you can decide whether you should apply for Amazon Pay Later.

Conclusion

Amazon Pay Later is a new payment option that offers customers the convenience of buying now and paying later, without requiring a credit card or any upfront payment. It can be useful for customers who need to make urgent or large purchases and do not have access to other forms of credit. However, customers should also be aware of the risks and disadvantages of Amazon Pay Later and use it responsibly and wisely.

What do you think of Amazon Pay Later? Have you used it or plan to use it? Let us know in the comments below. And don’t forget to share this article with your friends who might find it useful. 😊

Hey there! I’m Kuldeep Kumar, and tech is my jam. From the mind-blowing world of AI to the thrilling battlegrounds of cybersecurity, I love exploring every corner of this amazing world. Gadgets? I geek out over them. Hidden software tricks? Bring ’em on! I explain it all in clear, bite-sized chunks, laced with a touch of humor to keep things sparky. So, join me on this tech adventure, and let’s demystify the wonders of technology, one blog post at a time.