Do you want to buy something online but don’t have enough money right now? Do you want to pay your bills without any hassle or interest? If yes, then you might be interested in Amazon pay later, a payment option that lets you buy now and pay later on Amazon.

In this article, we will explain what Amazon pay later is, its eligibility criteria how it works, and why it is beneficial for online shoppers and bill payers. We will also guide you on how to register and use Amazon pay later on Amazon, how to manage and repay your balance, and how to use Amazon pay later for personal or commercial purposes.

Contents

- 1 What is Amazon Pay Later?

- 2 Benefits Of Amazon Pay Later

- 3 Eligibility Criteria For Amazon Pay Later

- 4 How To Register And Use Amazon Pay Later?

- 5 How to manage Amazon pay the later balance?

- 6 How to use Amazon pay later for personal or commercial purposes?

- 7 What are the alternatives to Amazon pay later?

- 8 Conclusion

- 9 Frequently Asked Questions

- 9.1 Is there any fee charged for making a purchase using Amazon pay later?

- 9.2 How to cancel Amazon pay later?

- 9.3 How to contact Amazon pay later customer care?

- 9.4 How to increase Amazon pay later limit?

- 9.5 What are the best products to buy using Amazon pay later?

- 9.6 How does Amazon pay later affect your credit score?

- 9.7 Share this:

What is Amazon Pay Later?

Amazon pay later is a convenient and flexible way to get instant credit for your online purchases and bill payments. You can choose to pay next month or over EMIs ranging from 3 to 12 months. You don’t need a credit card or any processing fee to use this service.

Benefits Of Amazon Pay Later

Once you apply for Amazon Pay Later you get a lot of benefits which are given below:

Amazon Pay Later offers you:

- Instant credit decision by the lender

- No credit card required

- No fees for cancellation or processing

- No charges for pre-closing the loan

- Seamless checkout on Amazon.in

- Easy tracking of EMI and expenses

With Amazon Pay Later, you can enjoy:

- Quick approval or rejection of credit by the lender

- No need for a credit card

- No extra fees for canceling or processing the order

- No penalty for paying off the loan early

- Smooth checkout process on Amazon.in

- Simple monitoring of EMI and expenses

Amazon Pay Later lets you:

- Get instant credit approval or disapproval by the lender

- Skip the credit card

- Avoid any fees for cancellation or processing

- Pay off the loan early without any charges

- Checkout easily on Amazon.in

- Track your EMI and expenses conveniently

Related: Disadvantages of Amazon Pay later

Eligibility Criteria For Amazon Pay Later

To use Amazon Pay Later, you need to meet the following eligibility criteria:

- You have an Amazon.in account

- You have a verified mobile number

- You have a PAN card

- You have a bank account with one of the selected banks

- You have a valid address proof, such as driving license, Aadhaar card, passport, utility bills (not older than 2 months), or Voter ID card

- You are 21 years or older

- You have a good credit history

- You satisfy any other conditions that Amazon may require

How To Register And Use Amazon Pay Later?

To use Amazon pay later, you need to register for the service on Amazon. The registration process is simple and quick, and you only need to do it once.

How to register for amazon pay later?

Here are the steps to register and use Amazon Pay later on Amazon:

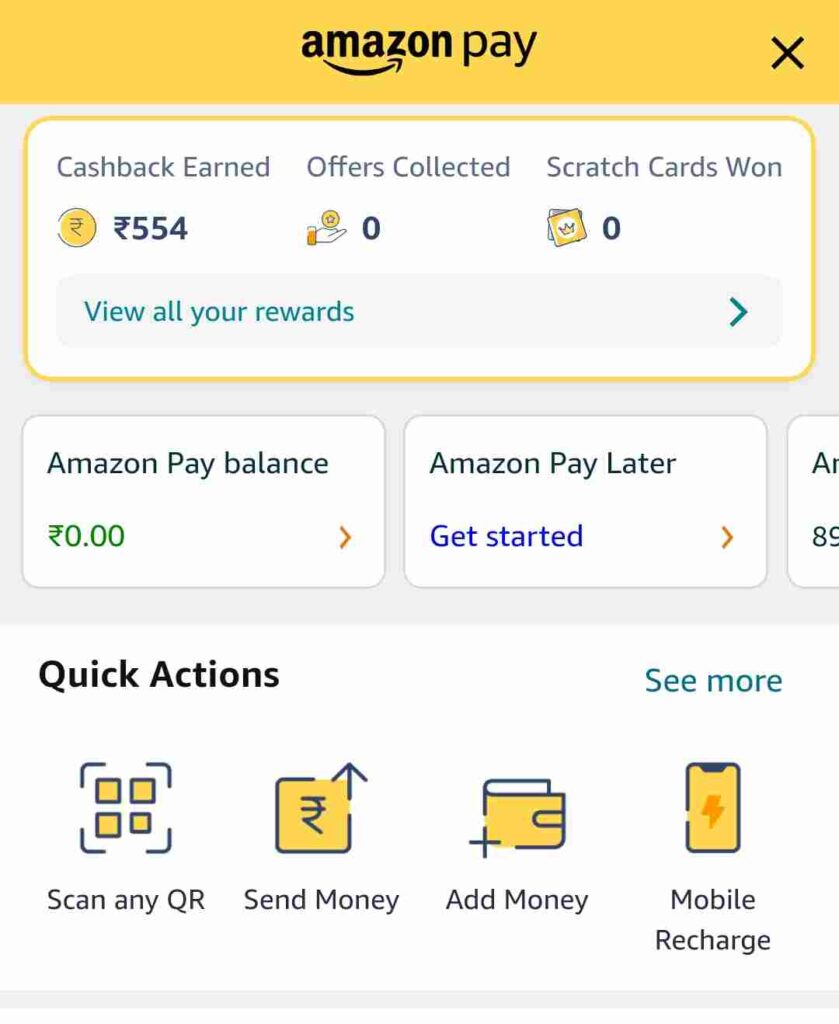

- Step 1: Go to Amazon App or website

⁸

⁸

- Step 2: Click on Amazon Pay visible on the screen.

- Step 3: Click on the Amazon Pay Later option visible on the screen

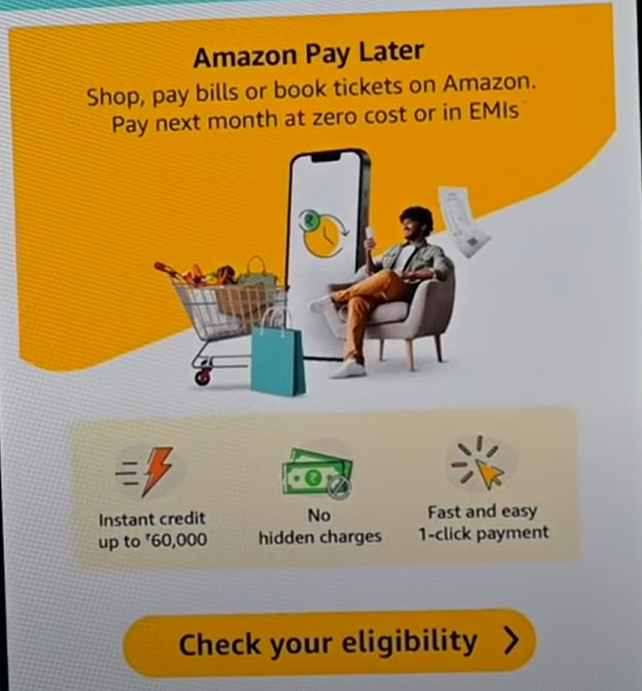

- Step 4: Now on the Amazon pay later page click on “Check Your Eligibility”.

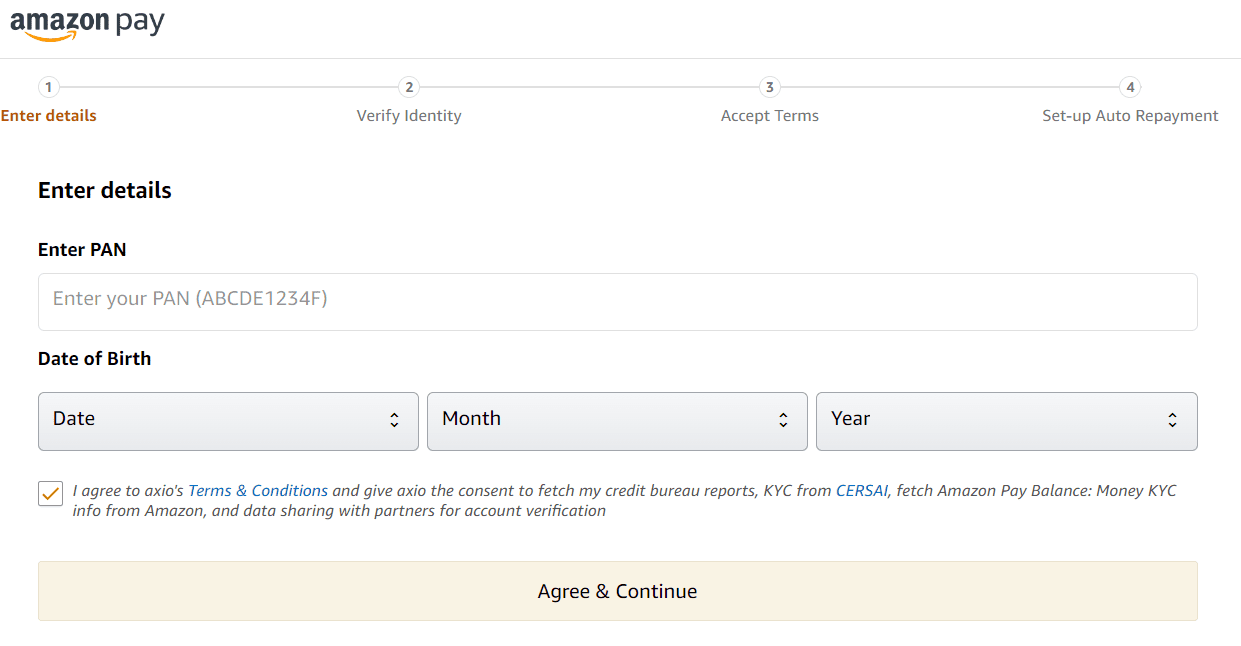

- Step 5: Once you click on the Check Your Eligibility option you will see a page where you will have to check your credit score. Enter all the details such as your First Name, Last Name, PAN Card number, and Date of Birth. Tick the check box of the terms and conditions and then press SUBMIT.

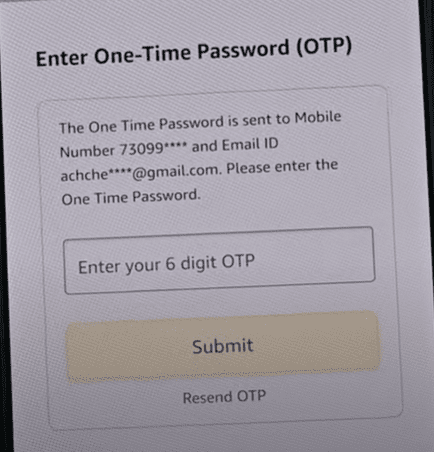

- Step 6: A OTP will come to your registered mobile number for verification. Enter the OTP and press SUBMIT. If you don’t receive any OTP you can press RESEND OTP.

It will take some time to fetch your credit score and will display your credit score.

- Step 7: Now on the Amazon pay later page click on “Signup in 60 Seconds”

- Step 5: Enter your PAN card number and verify it with an OTP sent to your mobile number linked to your Amazon account.

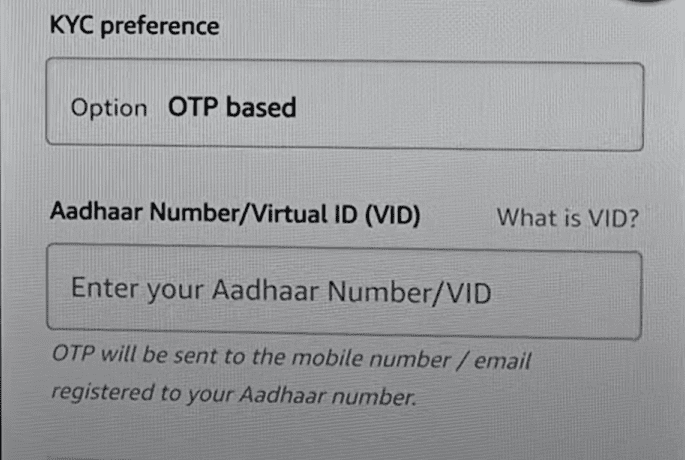

- Step 7: Do your KYC. Enter your Aadhar Number and click on Continue. Then enter the OTP you get on the number with which your Aadhard card is linked.

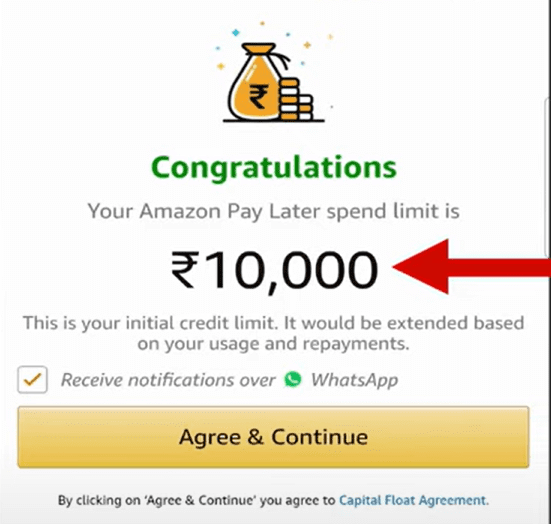

- Step 8: Once your KYC verification is complete, you will receive a confirmation message with the approved credit limit on your screen.

Steps To Step Up Auto Re-Payment On Amazon Pay Later

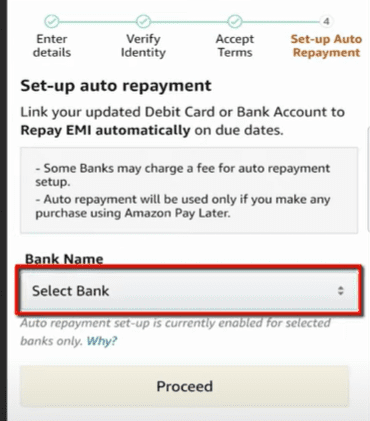

After getting an approved credit limit, you require to set up an auto re-payment option in Amazon Pay later. Follow the steps given below to set up:

- Step 1: After getting an approved credit limit, click on Agree & Continue button.

- Step 2: Click on the Select Bank option to select your bank.

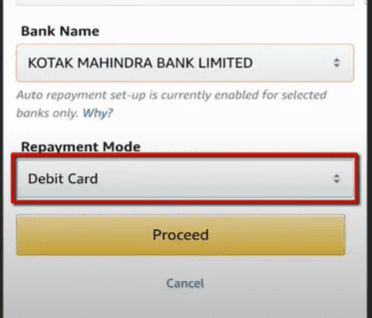

- Step 3: Select the Re-payment method. You can either choose a Debit Card or net banking. But I recommend you choose a debit card for a simple setup.

Then click on Proceed button.

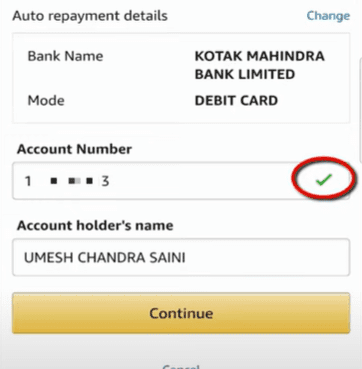

- Step 4: Enter your Account number and click on the Continue button.

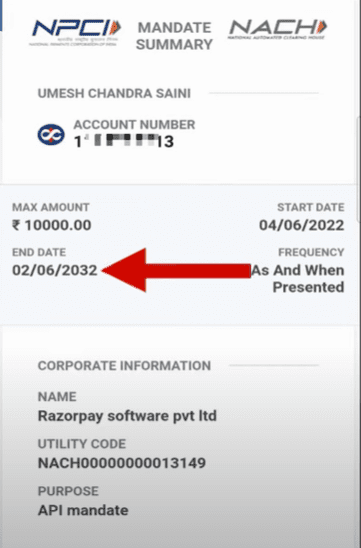

- Step 5: Your auto repayment information will appear on the screen. Review them and then click on Proceed

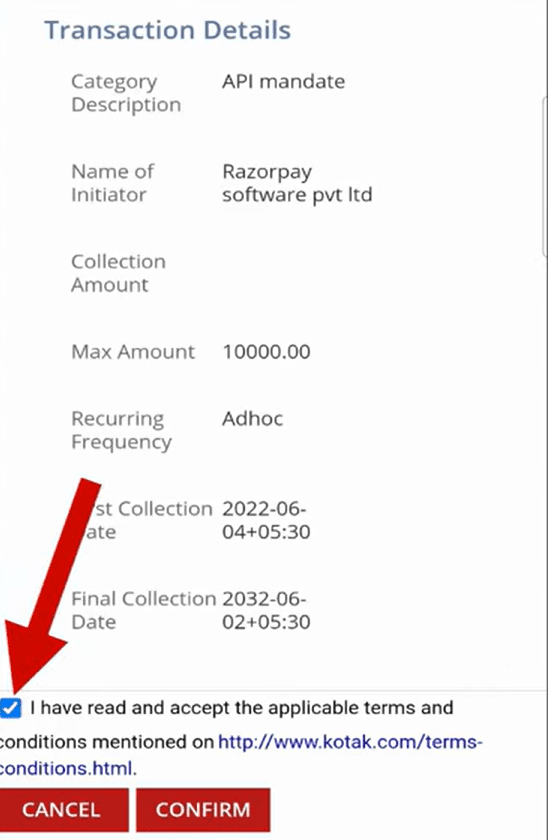

- Step 6: You will be redirected to your bank page where you have to fill in the required information. Fill them out and then click Proceed. You will receive an OTP. Enter the OTP and verify it. A final confirmation page will appear, agree to the terms and conditions by checking the tick box and then click on Confirm.

Now you are done, your Amazon Pay account is ready to use.

Related: How to Increase the Credit Limit of Amazon Pay Later? (5 Ways)

How To Use Amazon Pay Later?

To use Amazon pay later as a payment option at checkout, follow these steps:

- Step 1: Add the products or services you want to buy to your cart and proceed to checkout.

- Step 2: Select Amazon pay later as your payment method. You can also change your repayment plan from here if you want.

- Step 3: Confirm your order and complete the transaction. You will receive an order confirmation message and an email with your payment details.

How to manage Amazon pay the later balance?

You can easily manage and repay your Amazon pay later balance using the Amazon pay later dashboard on Amazon. The dashboard shows you your available credit limit, outstanding balance, due date, interest rate, and penalty charges for late payments. You can also view your purchase history, repayment history, and limit history on the dashboard.

How to use Amazon pay later for personal or commercial purposes?

Amazon pay later is a versatile and flexible payment option that you can use for various personal or commercial purposes. You can use it to buy products or services on Amazon or other platforms that accept Amazon pay as a payment method. You can also use it to pay your bills, such as electricity, water, gas, mobile, broadband, DTH, etc.

Some of the advantages of using Amazon pay later for your online shopping and bill payments are:

- Convenience: You don’t need to worry about having enough money in your bank account or wallet when you want to buy something online or pay a bill. You can simply use Amazon pay later and enjoy hassle-free transactions.

- Savings: You can save money by using Amazon pay later, as it offers zero interest rate for paying next month and low interest rate for paying over EMIs. You can also avail of various cashback offers, discounts, coupons, and deals that are exclusive for Amazon pay later users.

- Security: You don’t need to share your bank account or card details when you use Amazon pay later, as it is linked to your Amazon account. You also get a monthly statement and an email with your payment details, so you can keep track of your spending and repayments.

Related: Is Amazon Pay Later Safe?

What are the alternatives to Amazon pay later?

Some of the alternatives to Amazon pay later are:

- Credit cards: You can use credit cards to make online purchases and pay later with interest or over EMIs. However, credit cards may have higher interest rates, processing fees, annual fees, etc., and may require a good credit score to get approved.

- Debit cards: You can use debit cards to make online purchases and pay immediately from your bank account.

- UPI: You can use UPI to make online purchases and pay instantly from your bank account or wallet. However, UPI may have lower limits, transaction failures, etc., and may not offer any benefits or rewards.

- BNPL providers: You can use third-party BNPL providers such as Simpl, LazyPay, ePayLater, etc. to make online purchases and pay later with interest or over EMIs.

Conclusion

In this article, we have discussed what Amazon pay later is, how it works, and why it is beneficial for online shoppers and bill payers. We have also guided you on how to register and use Amazon pay later on Amazon, how to manage and repay your balance, and how to use Amazon pay later for personal or commercial purposes. If you want to try Amazon pay later for free and experience its advantages, visit https://www.amazon.com/amazonpaylater.

We hope you found this article helpful and informative. If you have any questions or feedback, please feel free to contact us or leave a comment below.

Frequently Asked Questions

Is there any fee charged for making a purchase using Amazon pay later?

There are zero fee charges for making a purchase using Amazon pay later. However, while choosing to pay by EMIs, there might be interest cost attached.

How to cancel Amazon pay later?

You cannot cancel Amazon pay later once you have registered for it. However, you can stop using it as a payment option at checkout. You can also close your Amazon pay later account by contacting the customer care of the lending partner (axio or IDFC FIRST Bank) and paying off your outstanding balance.

How to contact Amazon pay later customer care?

You can contact Amazon pay later customer care by calling the toll-free number 1800-419-0416 or by emailing cs@amazonpay. You can also visit the Amazon pay later help page on Amazon and click on “Contact Us” to chat with a customer service representative.

How to increase Amazon pay later limit?

To increase your Amazon pay later limit, you need to be a regular and frequent user of the service and make as many purchases and repayments as you can. Your limit is decided based on various factors such as your credit history, purchase history, repayment history, etc. The more you use Amazon pay later, the more likely you are to get a higher limit. You can also check your limit history on the dashboard and see how it has changed over time.

What are the best products to buy using Amazon pay later?

You can use Amazon pay later to buy any product or service that is available on Amazon or other platforms that accept Amazon pay as a payment method. However, some of the best products to buy using Amazon pay later are:

- Electronics

- Groceries

- Books

- Fashion

How does Amazon pay later affect your credit score?

Amazon pay later may affect your credit score positively or negatively depending on how you use it. If you make timely repayments and do not exceed your credit limit, it may improve your credit score as it shows your creditworthiness and responsibility. However, if you default on your repayments or exceed your credit limit, it may lower your credit score as it shows your delinquency and riskiness.

Hey there! I’m Kuldeep Kumar, and tech is my jam. From the mind-blowing world of AI to the thrilling battlegrounds of cybersecurity, I love exploring every corner of this amazing world. Gadgets? I geek out over them. Hidden software tricks? Bring ’em on! I explain it all in clear, bite-sized chunks, laced with a touch of humor to keep things sparky. So, join me on this tech adventure, and let’s demystify the wonders of technology, one blog post at a time.